Helping with the cost of Care

The cost of care in later life can sap your lifetime savings, force you to sell your home and leave you with very little to pass on to your children. It is a worry for many people and although funding from the local authority is available, it only comes into effect when you have less than £23,250 of assets remaining.

Parliament is currently considering a proposal which tries to protect people’s savings and homes from unlimited care costs by offering a ‘fairer capped funding system’. If it is passed, by 2016 it could give you more options when looking at funding long term care. The Care Bill proposes the following for those people needing to fund their own care:

- Local authorities will help with the cost of care sooner through changes to the means tested capital limits

- A cap on the total amount you have to pay for care will be introduced

- The ability to defer the payment of care costs for everyone allowing you to keep your home

Those are the headlines but is it all as good as it sounds?

Helping with the cost of care sooner

Currently help to pay for the cost of residential care from the local authority does not begin until the value of your capital falls below £23,250. All of your income (except for a small personal expenses allowance) will be expected to be paid towards the cost of your care and the local authority may then start to contribute towards the difference. Only when your capital falls below £14,250 may the local authority start fully covering this shortfall.

Under the new proposals, these limits are changing. For those people whose wealth is less than £118,000 including their home, depending on income, the local authority may start to help with the cost of funding care. A property will not be included in the assessment of assets if you, a partner or dependent still lives in the home. If the house is excluded, this upper limit drops to £27,000. The threshold at which the local authority may start fully covering the shortfall between residential care costs and income rises to £17,000 from £14,250.

For those people who qualify for the £118,000 limit at which help begins, these proposals could, on the face of it, lead to a substantial saving. However for every £250 of capital above the £17,000 threshold, an additional £1 is added to the assessed income. So the maximum amount of capital each week that may have to be used to pay for care is £404 [(£118,000-£17,000) ÷ 250 = £404]. Therefore, if you are receiving pension income, the local authority may not start contributing to the cost of residential care until your capital has depleted to a much lower level depending on the cost of your care and the level of your income.

A cap on the total cost of care

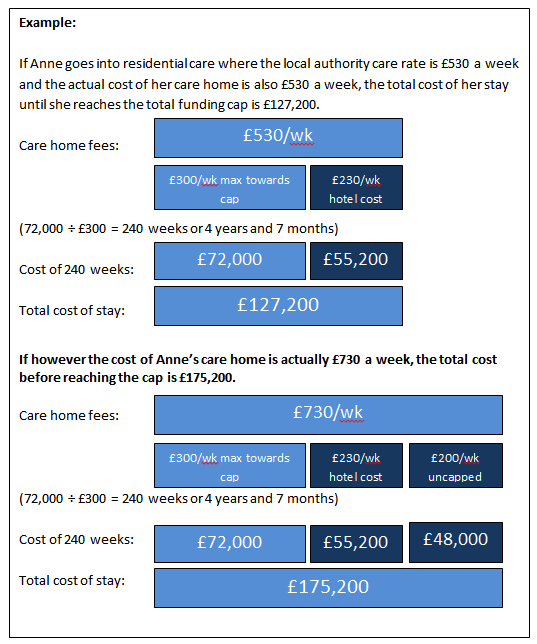

The proposed reforms offer a limit to the amount you will have to pay for care from your capital of £72,000 where in the past this cost was unlimited. However behind this headline figure, the amount you have to pay for residential care may actually be substantially more. Firstly, spending towards this limit only applies when the assessment of your care needs have been deemed substantial.

This limit also excludes the hotel costs of being in residential care which is provisionally set at £12,000 per annum (£230 a week) which means that this amount will not count towards the £72,000 cap.

Also, care costs that will be allowed will only be up to the maximum rates that your local authority would pay for your care were they fully funding it. This means that if the actual cost of care in the residential home you are in is higher than this, you will have to continue funding the difference.

For many people going into residential care, the thought of losing their home to pay for these costs can be upsetting. If you have someone living with you who is not your partner or a dependent, they may be forced to move out. Currently some local authorities will allow you to keep your property by deferring the payment of your care fees until your death when this will be repaid from your estate. This is an interest free loan but is only offered at the local authority’s discretion.

The Care Bill proposes that everyone will have the right to keep their home during their lifetime with a loan being created against the property but interest will be charged at a commercial rate and administration fees will be applied. This does mean however, that anyone else living in your property will be able to remain there and you will have the option of allowing tenants to move in.

The solution?

As you can see, if the Care Bill goes through parliament and into law as expected, the reality is rather different to the headlines. Yes, on the whole the changes will be beneficial to those who require residential care however overall cost to your capital may be more than you first think and compared to the current regime, savings on care costs may be modest.

Another factor to consider is that everyone who may wish to benefit from the cap will have to submit to a financial assessment by the local authority at an early stage to get the clock ticking, an intrusion that not all individuals will wish to have.

It is important that all of us understand what we will be expected to pay for residential care and to plan how best to meet this cost. Forward financial planning it vital as there are a number of strategies available to help minimise the risk to capital of care fees funding and, whilst we can and do help clients at the point of need, the earlier you plan for this the better.

For more information about this, please do speak to me or your usual contact at Chilvester.